This is big news indeed. Pay attention.

The latest twist in the Staley vs. Gilead lawsuit could signal very bad things for Gilead Sciences and Janssen Pharmaceuticals. As the case barrels forward (a jury date is set for March 2023), it could eventually cost Big Pharma billions of dollars in profits that the lawsuit contends has been the result of illegally shaking down people living with HIV and our insurers.

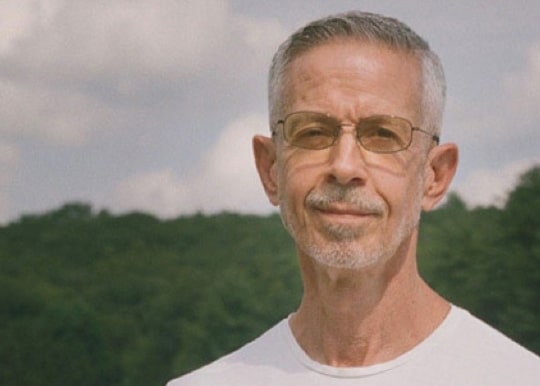

In this new, exclusive interview with My Fabulous Disease, lead plaintiff and HIV activist Peter Staley breaks down the latest legal developments, and he doesn’t hold back on the juicy details – including why the proposed removal of one of the pharmaceutical defendants actually helps the activists’ lawsuit.

The case is a thrilling example of what happens when HIV activism takes its ferocious ingenuity from the streets to the courtroom. The ramifications could even extend beyond HIV and apply to people taking high-priced medications for other illnesses.

Let’s walk through the basics of the lawsuit and get Staley’s take on what it all means. This can be wonky stuff but it’s worth it. We all have skin, and dollars, in this game.

The basics of the “Staley et al vs. Gilead Sciences” lawsuit

The private agreements between Gilead, Janssen, and Bristol Myers Squibb, hidden until recently from prying eyes, allegedly sought to keep the cost of HIV medications at about $40,000 per year, per patient, even after ingredients in “combo” medications (pills containing more than one drug, sometimes made by different pharma companies) became generic, which typically makes the medication far less expensive.

“This whole case is about the contracts between the pharmaceuticals about these generics,” Staley explained. “Deep in those contracts is language that keeps generics out of the combo pills. If one of the drugs in the combo goes generic, the companies agreed not to use the generic version in the combo. That’s what the whole case is about.”

The lawsuit accuses the drug companies of colluding to keep generic ingredients out of the combo pills, thereby maintaining a cost of HIV medications of around $40,000 per year, per patient. I won’t bother adding “allegedly” every time I tell you about Big Pharma’s sleazy behavior. When dealing with Big Pharma, it’s a given.

There are two mirror-image lawsuits happening, by the way, the second being a “copycat” lawsuit with different plaintiffs involved. For simplicity, we’re going to focus on Staley vs Gilead, the lead suit in this fight. Among the plaintiffs alongside Staley are fellow HIV activists Gregg Gonsalves, Brenda Goodrow, Andrew Spieldenner, Robert Vázquez and Jason Walker, along with other consumers.

What the proposed Bristol Myers Squibb settlement really means

Last week it was announced that one of the defendants, Bristol Myers Squibb, has proposed settling its portion of the lawsuit for $10 million. Media reports left the impression that this was the beginning of the end of the lawsuit, and for a cheap price tag at that. Nothing could be further from the truth.

First, Bristol’s settlement has to be approved by the judge of the antitrust case. That hasn’t happened yet. But more importantly, the proposed settlement plays right into the hands of Staley and crew by isolating the remaining defendants, Gilead and Janssen, who have far more financial exposure.

And get this. The proposed settlement wasn’t even Bristol’s idea.

“We went to Bristol to suggest a settlement,” Staley revealed. “There was very little liability left on the line for them”

Why? Because Evotaz, the Bristol drug involved in this, is an older HIV medication that very few patients use anymore. The $10 million settlement would reimburse co-pays spent on the Bristol drug that would have cost much less if the generic component had been used. (The lawsuit can only seek damages for the last five years, because of the statute of limitations for antitrust cases, Staley noted.)

But Staley isn’t nearly as interested in money as much as the other terms of the proposed settlement. And those terms are much more ominous for Janssen and Gilead, the remaining defendants. Of all the patients newly diagnosed with HIV, 90% will begin a treatment regimen that includes a Gilead drug. Their exposure in this lawsuit cannot be underestimated.

As part of their settlement agreement, Bristol would walk away from their secret agreement with Gilead, allowing a generic to be used in their combo medication. Even though Bristol released a boilerplate statement denying any wrongdoing, blah blah blah, their proposed settlement breaks the former, secretive agreement and repays the people who suffered financially as a result. Actions speak louder than words, and these actions say quite a lot.

“We never launched this case for money,” Staley said. “We launched this case because we exposed this illegal pharma practice. By getting Bristol to walk away, it’s telling the world and the judge that one of the big defendants knows that this agreement between them wasn’t kosher.”

“Bristol just threw Gilead and Janssen under the bus,” Staley added, “and they said to them, ‘you’re on your own.’”

How the lawsuit could play out from here

“Big Pharma conspired to keep low-cost medications out of the hands of patients whose lives depended on them and bled them for tens of thousands of dollars when cheaper drugs could have been used in their combination pills.”

That’s how the case might be explained to a jury, in one simple sentence. Just try to justify that behavior, Big Pharma.

Almost every antitrust case is settled the week before trial and usually after every strategy on behalf of defendants to end the case has been attempted. The pharma lawyers have already tried to have this case dismissed more than once but the judge has allowed it to move forward. This is real, folks.

The most delicious part of any proposed settlement from Janssen and Gilead is that they can’t settle without the approval of Peter Staley and the other activist plaintiffs. Big Pharma must go through the activists if and when they want to settle. That fact alone gives me warm tingles all over.

A potential settlement from HIV pharma giant Gilead, for instance, might cover reimbursing the co-pays for the last five years on some of the most widely used drugs in the HIV arena, not to mention future profit they might have otherwise collected. That’s not millions of dollars, or even hundreds of millions. That’s billions of dollars in patient savings.

“All those contracts will have to be rewritten,” Staley said. “The new contracts should allow that, whenever a drug involved in a combo pill goes generic, a combo version will come out that’s cheaper than the fully branded one. Now, if you were Blue Cross, which version of the combo pill would you pay for?”

What this all means to HIV treatment progress in the future

Soaking Big Pharma for damages due to their shameless greed and contractual shenanigans would be satisfying, but there is an even better outcome that speaks to the future of HIV treatment itself.

“Monopolies kill innovation,” Staley warned. “We had massive innovation in the 1990s, including the advent of multi-drug therapies, which started saving lives, and new drug categories like protease inhibitors were developed. By 2005, we had more than 30 HIV drugs on the market, plus a new class called integrase inhibitors.”

The problem was that Big Pharma got fat and happy and sat on its corporate research butt while they held the patent to these new treatments, changing formulations here and there to extend the patents but otherwise inventing nothing new. Then, when the drugs faced going generic at the end of the patents, the defendants started combining the pills and signing these shady contracts to keep out the generic formulations and keep profits high.

“What innovation,” Staley asked, “has happened since 2005? Nothing. Except this year we finally got a one- or two-month long-acting treatment, but that technology has existed for years.”

In other words, should this lawsuit wreck the gravy train Big Pharma has ridden all these years, they’re going to have to get truly innovative if they want to make that kind of money in the HIV market again.

“Economics 101 says innovation is the only way to get a higher price,” Staley said.

Just imagine what Big Pharma might come up with if they were forced to innovate again. Perhaps they would develop much longer acting medications or, God forbid, an actual cure for HIV. Our capitalist system would reward them handsomely for that.

Case in point: the treatment regimen for Hepatitis C went generic a decade ago, ending huge pharma profits and forcing them to come up with something better. Gilead’s answer was Sovaldi in 2014, an actual cure for Hepatitis C that eclipsed previous sales records. Sovaldi raked in $2.27 billion in sales in the first three months it was available. 2.27 BILLION DOLLARS.

If Big Pharma wants to make money in the HIV arena again, maybe they should stop trying to illegally corner the market and actually invent something new.

The fallout of this lawsuit beyond HIV

It would be naive to presume that the kind of backroom agreement Big Pharma cooked up for their HIV combo pills is limited to their HIV portfolio, don’t you think?

You can bet your bottom dollar that, once this lawsuit is settled, Staley & Company will begin to examine other agreements pharmaceuticals have with one another. Heavens knows what might turn up.

Meanwhile, coming in March of 2023, a jury could be weighing whether Gilead and Janssen were so monumentally vile as to deliberately keep affordable medications out of the hands of people who depend upon them for their very lives.

“We welcome a jury,” Staley said. “We feel very confident about explaining this case to them.”

Stay tuned.

Mark